Geographic Pricing: The Strategic Imperative for Unlocking Global Software Markets

Executive Summary: Beyond Flat-World Pricing

The global digital economy, once envisioned as a frictionless, borderless marketplace, operates on a starkly different reality. While connectivity is increasingly universal, economic power is not. For software and digital service providers, clinging to a uniform global pricing model is no longer a viable strategy; it is a self-imposed limitation on growth, an artificial barrier that excludes billions of potential customers, and a critical vulnerability in the face of more agile, globally-minded competitors. This report argues that strategic, data-driven geographic pricing, specifically models based on Purchasing Power Parity (PPP), has transitioned from a niche or purely ethical consideration to a fundamental imperative for market penetration, competitive resilience, and sustainable growth.

The economic disparities between developed and emerging markets are too vast to be serviced by a single price point. A modest subscription fee in a high-income country can represent a prohibitive portion of household income in a lower-income one, effectively locking out entire nations from the digital ecosystem. This is not a theoretical problem; it is a tangible barrier that has been successfully dismantled by the world’s leading digital platforms. Industry giants like Netflix and Spotify have leveraged sophisticated, region-specific pricing as a primary engine for their international expansion, unlocking explosive subscriber growth in markets previously deemed inaccessible. Their success provides an undeniable validation of the PPP thesis.

Furthermore, the implementation of geographic pricing is not merely a commercial tactic but a catalyst for profound innovation. As this report will demonstrate through the case study of The Simple Different Company and its FairDif index, the constraints of serving low-margin, mobile-first markets force a level of product discipline and efficiency that results in superior, more universally accessible products. This process forges a sustainable competitive advantage that is difficult for competitors focused on high-margin markets to replicate.

Finally, the shift towards geographic pricing is being accelerated by powerful external forces. Regulatory bodies, most notably the European Union, are actively legislating against unjustified "geo-blocking," establishing a legal precedent for fairer access. Simultaneously, the investment community, from venture capital to private equity, increasingly recognizes sophisticated pricing strategies as a hallmark of a well-run, globally-aware company poised for scalable growth.

This report will dissect these interconnected dynamics, providing a comprehensive framework for understanding and implementing geographic pricing. It will move from the foundational economic rationale to industry-validated case studies, technical implementation blueprints, and the evolving regulatory and investment landscape. The conclusion is unequivocal: the era of flat-world thinking is over. The future belongs to companies that possess the economic intelligence and strategic foresight to price their products for the world as it truly is—diverse, dynamic, and filled with untapped opportunity.

I. The Economic Reality of a Digitally Connected, Economically Divided World

The promise of a global marketplace, where a digital product can be delivered to anyone, anywhere, at any time, collides with the unassailable fact of global economic inequality. A pricing strategy that ignores this disparity is not a global strategy at all; it is a strategy for a small, wealthy fraction of the world. Understanding the depth of this divide is the first step toward unlocking the true potential of the global market.

The Affordability Chasm: San Francisco vs. Mumbai and Beyond

The concept of "fair value" is fundamentally tied to local economic context. A single price point for a software product creates dramatically different levels of economic burden, effectively functioning as a form of geographic discrimination that limits market access. A comparison between a high-income metropolitan area in a developed nation and a major city in an emerging economy illustrates this chasm with stark clarity.

Consider a hypothetical software-as-a-service (SaaS) product priced at $109 annually. For a household in San Francisco, California, this cost is almost negligible. According to the U.S. Census Bureau, the median household income in San Francisco for the 2019-2023 period was $141,446.1 Other official sources, such as the California Department of Housing and Community Development, cite an even higher Area Median Income of $186,600 for 2025 to determine eligibility for housing programs.3 Using the more conservative census figure, the $109 software subscription represents just 0.077% of the median household's annual income.

The situation in Mumbai, India, is profoundly different. While directly comparable median household income data is less centralized, available sources paint a consistent picture of a vastly different economic scale. A 2016 analysis reported an average annual disposable income of $8,214.4 A more recent analysis from approximately 2022, using crowd-sourced data, cited a median household income of around $5,200.5 State-level data for Maharashtra, where Mumbai is located, shows an average monthly salary of approximately ₹20,110 (about $241 USD), which annualizes to less than $2,900.6

Against these figures, the same $109 software cost transforms from a trivial expense into a significant financial decision. It represents between 2.1% and 3.8% of the cited annual income figures for Mumbai—a relative economic burden that is 27 to 49 times greater than for a household in San Francisco. This is not a marginal difference that can be overcome with clever marketing; it is a structural barrier to entry that effectively excludes the vast majority of the market. This disparity is the foundational problem that Purchasing Power Parity (PPP) pricing is designed to solve. It is not about offering a discount; it is about offering a product at a commensurately affordable price point, thereby creating a viable market where one previously did not exist.

The Mobile-First Mandate: Reaching the Next Two Billion Users

The economic disparity is compounded by a technological one. The primary portal to the digital world for the majority of the global population, and especially for the fastest-growing user bases in emerging economies, is not the desktop or laptop computer but the smartphone. A global strategy that is not mobile-first is, therefore, a strategy that ignores the primary access point for its largest potential markets.

The data supporting this shift is definitive. In the first quarter of 2023, mobile devices (excluding tablets) accounted for 58.33% of all global website traffic, according to data from Statista.7 This trend is even more pronounced in the very markets where affordability is a key issue. In Africa, mobile devices generate 69.13% of web traffic, while in Asia the figure is 65.2%.8 The dominance is not just in traffic but in overall access; a staggering 95.8% of global internet users leverage a mobile phone to get online, a significantly larger cohort than the 62.9% who use a laptop or desktop.7

The future trajectory is even clearer. Projections from the World Advertising Research Center (WARC) indicate that by 2025, nearly 3.7 billion people will depend solely on their smartphones to access the internet.7 These users are not simply "mobile-first"; they are "mobile-only." For them, a product that offers a degraded or incomplete experience on a mobile device is not a viable product at all.

This reality has profound implications. It means that serving emerging markets is a dual challenge of both pricing and product design. The combination of high mobile penetration and lower disposable incomes gives rise to a "Value-Per-Megabyte" sensitivity that is less acute in wealthier, fixed-broadband markets. Users in many emerging economies rely on cellular data plans that are often metered and represent a real, variable cost. Consequently, a potential customer is evaluating not only the subscription price of a piece of software but also the data cost required to download, update, and operate it. Feature bloat, inefficient code, and large application sizes are not mere inconveniences; they are a direct tax on the user, diminishing the product's value proposition. This dynamic inextricably links fair pricing to lean, efficient, and purposeful product development.

Furthermore, the term "emerging market" itself is a vast oversimplification that can mask critical economic diversity. The data on global pricing from successful platforms reveals significant variations not just between developed and emerging regions, but within them. Spotify's monthly price in Argentina ($2.00) is less than half its price in Brazil ($4.50), which is in turn slightly lower than its price in South Africa ($4.62).9 Treating these distinct economic environments with a blunt, two-tiered "Developed/Emerging" pricing model would be a crude and ineffective instrument. This heterogeneity elevates the importance of a sophisticated, granular, country-by-country pricing index—one capable of adapting to the specific economic context of each nation rather than applying a simple regional discount. The strategic challenge is not merely "discounting for the poor," but rather "precision pricing for a complex and heterogeneous global economy."

II. Industry Validation: The Proven Success of Regionalized Pricing

The theoretical case for geographic pricing is compelling, but its strategic value is most powerfully demonstrated by the real-world success of global market leaders. The world's most dominant digital subscription services have not achieved their scale by imposing a single price on the world. Instead, they have embraced regionalized pricing as a core pillar of their growth strategy, providing an unambiguous and data-backed playbook for how to unlock global markets.

Case Study: Netflix's Global Expansion Playbook

Netflix's journey from a US-centric service to a global entertainment powerhouse is a masterclass in strategic market adaptation. A critical component of this success has been its sophisticated and aggressive use of geographic pricing to penetrate diverse economic landscapes. This strategy goes far beyond simple currency conversion; it involves creating vastly different value propositions tailored to local purchasing power.

The price variation across countries is extreme. A standard, ad-free Netflix subscription can cost as little as $2.86 per month in Pakistan.10 In stark contrast, the same or a similar plan costs $13.36 in the United Kingdom and a remarkable $22.82 in Switzerland.10 The price in Pakistan is less than the cost of a single cup of coffee in Zurich, a clear indication that Netflix is not adjusting its price by a few percentage points but is fundamentally re-calibrating its offering to fit the local economic reality. This represents a price variation of over 690% between the two markets, a testament to the depth of its pricing strategy.

This approach has been instrumental in fueling Netflix's primary growth engine: international expansion. As growth in the saturated North American market has slowed, the Asia-Pacific (APAC) region has emerged as a key driver of new subscriptions.12 This growth is directly linked to pricing adjustments. In India, a notoriously price-sensitive market, Netflix added nearly one million new subscriptions in the second quarter of 2024 alone, a surge that followed concerted efforts to adapt its pricing strategy and introduce more accessible, lower-cost plans.12

Market analysis confirms this causal link. Ampere Analysis directly attributes the low uptake of streaming services in regions like Sub-Saharan Africa to the high price of these services relative to local income levels, making discounted bundles and partnerships essential for growth.13 In a decisive strategic move, Netflix implemented price drops in over 100 territories, a decision that affected more than 10 million subscribers. This was not a minor tweak but a large-scale pivot designed to drive subscriber acquisition in emerging markets by making the service more accessible.14 This evidence demonstrates that for Netflix, geographic pricing is not an experiment but a proven, indispensable tool for global market leadership.

Case Study: Spotify's Subscriber Growth Engine

If Netflix provides the playbook for geographic pricing, Spotify offers an even more aggressive and compelling case study. The music streaming giant has utilized PPP-style pricing to become the dominant force in its sector, with a strategy that has made its premium service accessible to hundreds of millions of users in developing nations.

The price differentials in Spotify's model are even more dramatic than Netflix's. The monthly cost for a premium individual plan ranges from a high of $15.84 in Denmark to an astonishingly low $0.56 in Nigeria.9 This represents a price difference of nearly 2,800%, or a factor of 28x. Other highly affordable markets include Pakistan at $1.25 per month and India at $1.42.15 These are not discounts; they are entirely different price categories designed to create a mass-market product in economies where a $10 monthly fee would be a luxury good.

This strategy is directly and explicitly tied to user growth. Emerging markets are the undisputed engine of new subscriber acquisition for Spotify. The company's own reports detail the explosive growth in consumption of Indian music and the number of Indian artists earning significant royalties on the platform since its 2019 launch—a period defined by its aggressive, localized pricing.16 In a highly competitive and price-sensitive market like India, Spotify has successfully established itself as a market leader with an approximate 26% market share.19 This achievement would be inconceivable without a pricing model that aligns with the economic realities of the Indian consumer.

The strategic logic behind these pricing models is more sophisticated than simple discounting. A closer look reveals a two-pronged global approach: using low PPP-based prices to acquire users and capture market share in high-growth, price-sensitive regions, while simultaneously implementing calculated price increases in mature, less price-sensitive markets like the United States, the United Kingdom, and various European nations.21 This is a form of advanced yield management that seeks to maximize revenue from established user bases while maximizing growth in new ones. It reframes PPP pricing not as a tool for charity, but as a crucial component of a global revenue and user maximization strategy.

For publicly traded companies like Netflix and Spotify, this heavy investment in localized pricing would be unsustainable if it were merely a loss-leader. The clear implication is that the lifetime value (LTV) of a customer acquired at a lower price point in an emerging market is still highly profitable relative to the acquisition cost. For a software company with near-zero marginal costs of delivery, acquiring a loyal, long-term user in Nigeria for $0.56 per month or in Pakistan for $1.25 per month is a sound and profitable business venture. This shifts the strategic question from "Can we afford to lower our prices?" to the more urgent "Can we afford not to acquire these millions of profitable users?"

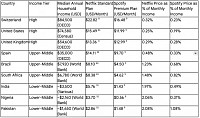

Global Pricing & Affordability Matrix

To visualize the dramatic impact of these strategies, the following table compares pricing for Netflix and Spotify across a spectrum of countries, juxtaposing the absolute U.S. dollar price with the relative burden it represents as a percentage of the local median monthly household income.

Note: Income data is from a variety of sources (OECD, World Bank, National Census) and represents the most recent available estimates, which may not align perfectly with the year of the pricing data. The figures for India, Nigeria, and Pakistan are broad estimates to illustrate scale. The purpose of the table is to demonstrate the strategic normalization of affordability across vastly different economies.

This matrix provides undeniable evidence that the world's leading digital subscription services do not use flat-world pricing. The crucial columns are the final two, which show a clear strategic effort to manage the economic burden on the consumer. While the absolute price is low in Pakistan or Nigeria, the pricing strategy ensures the relative cost remains within a manageable, mass-market range, dismantling any argument that a single global price is a fair or effective approach.

III. The FairDif Model: A Blueprint for Economic Intelligence in Pricing

While the success of giants like Netflix and Spotify validates the "why" of geographic pricing, their immense resources can make the strategy seem unattainable for smaller companies. The challenge lies in the "how": the complex, data-intensive process of creating and maintaining a pricing model that is both fair and commercially viable across dozens of diverse economies. This is the problem that The Simple Different Company set out to solve with its FairDif index, creating a replicable blueprint for implementing economic intelligence in pricing.

Beyond Simple Discounting: The Architecture of a True PPP Index

A robust PPP strategy is far more sophisticated than applying a simple regional discount. It requires a dynamic, multi-factor model that can accurately reflect the true purchasing power of consumers in each specific country. The FairDif index serves as a case study in this level of sophistication, elevating the concept from a basic pricing tactic to a form of applied economic intelligence.

The strength of the FairDif model, as described in its methodology, lies in its integration of multiple, authoritative data sources.25 Rather than relying on a single, often misleading metric like GDP per capita, a best-practice approach triangulates data to create a more holistic view of an economy. This includes:

World Bank GDP data: To establish the overall economic output and income level of a nation.

OECD Price Level Indices: To compare how much a standardized basket of goods costs in different countries, providing a direct measure of price disparity.

Crowd-sourced Cost-of-Living Metrics (e.g., Numbeo): To capture real-time, on-the-ground data on everyday expenses like rent, groceries, and transportation, which heavily influence a consumer's disposable income.

By synthesizing these diverse data streams, the index can generate a much more accurate and nuanced price point for each country. This approach avoids the pitfalls of simpler models, ensuring that prices are aligned not just with national wealth, but with the actual cost of living and the real-world economic pressures faced by consumers. This technical sophistication is analogous to the complex indexing required for modern data retrieval. Just as a search engine relies on a specialized index like Faiss to efficiently query billions of data points 27, a global pricing engine requires a sophisticated economic index like FairDif to manage the complexity of over 140 distinct national economies.

Solving the Localization Challenge: Infrastructure for Global Access

One of the greatest practical barriers to implementing a comprehensive PPP strategy is the sheer operational complexity of localization. Managing unique prices, currencies, and languages for every market can quickly become an overwhelming logistical challenge. The FairDif model's design directly addresses this by building the solution into a scalable infrastructure.

The system's ability to automatically adjust pricing for 141 different countries while simultaneously supporting over 30 languages is its most powerful feature.25 This is not merely a convenience; it is a core piece of infrastructure that makes a global PPP strategy feasible for an organization without the vast resources of a multinational corporation. It automates what would otherwise be a continuous, resource-intensive manual effort of research, engineering, content management, and payment gateway integration. This infrastructure is a key differentiator, creating a significant barrier to entry for competitors who have not made a similar foundational investment.

The investment in building such a system yields benefits that extend far beyond pricing. The technical backbone required to support multi-language interfaces and multi-currency payment processing is the very same infrastructure needed for superior global customer support and effective product-led growth. It enables localized marketing campaigns, multi-language help guides, and the ability to gather and analyze product feedback from a truly diverse global user base. Therefore, the effort to build a PPP system is not a siloed cost center but a strategic investment in becoming a "global-native" company from the ground up.

The SimDif Trajectory: A Case Study in Sustainable Growth

The ultimate validation of the FairDif model is the growth trajectory of The Simple Different Company itself. The company's story—evolving from a small, 12-person team in Chiang Mai, Thailand, to a global service with over 4 million downloads serving users across more than 150 countries—provides a powerful proof point for the effectiveness of its pricing philosophy. This growth was achieved not through massive venture capital-fueled marketing campaigns, but through organic adoption driven by a fair value proposition.

By getting the price right for each market, the product was able to grow organically, pulled in by market demand rather than being pushed by expensive advertising. This demonstrates a core principle: when a product is priced accessibly, the market itself becomes the most powerful growth engine. This narrative offers a compelling alternative to the capital-intensive growth models common in the tech industry, showing a path to sustainable, profitable global scale.

Over time, a proprietary PPP index like FairDif evolves from a pricing tool into a strategic data asset. As the company collects conversion, retention, and usage data at different price points in every country, it builds a unique and invaluable dataset on global price elasticity for digital goods. This data can be used to create predictive models, allowing the company to forecast the revenue and growth impact of pricing adjustments with increasing accuracy. This knowledge, and the underlying data itself, constitutes a powerful, non-replicable competitive moat that becomes more formidable with every new user and every transaction processed.

IV. The Unintended Benefit: How Fair Pricing Forges Product Supremacy

The most profound and counterintuitive consequence of adopting a strict Purchasing Power Parity pricing model is not commercial, but developmental. While the immediate goal is to make a product affordable, the long-term result is a better product. The constraints imposed by the need to deliver value in low-margin markets act as a powerful catalyst for innovation, forcing a degree of discipline and focus that ultimately benefits all users, regardless of what they pay.

The Constraint Principle: Eliminating the High-Margin Crutch

Traditional SaaS pricing models, particularly those that rely on a single, high global price, often create a dangerous complacency. Companies can achieve profitability by selling to a small number of high-margin customers in wealthy markets like the United States and Western Europe. These substantial profits can then be used to subsidize inefficient product development, feature bloat, and a mediocre user experience. This "high-margin crutch" allows companies to survive, and even thrive, without ever being forced to build a truly exceptional, universally valuable product.

PPP pricing eliminates this crutch. When a company must build a sustainable business serving customers in Vietnam for $2 per month or in Nigeria for less than $1, there is no margin for error. Every feature must be ruthlessly evaluated for its value and cost. The product cannot afford to be slow, confusing, or data-intensive. This constraint forces a relentless focus on the core value proposition. It demands efficiency, simplicity, and an intuitive user experience not as aspirational goals, but as survival requirements. This discipline, born of economic necessity, is the crucible in which superior products are forged.

Case in Point: SimDif's Mobile-First Breakthrough

The story of the SimDif website builder provides a concrete example of this principle in action. The company's commitment to serving a global audience, including the vast mobile-only populations in emerging markets, created a unique product development challenge. To be a viable tool for these users, the website builder had to be fully functional on a smartphone. This was not a feature the team chose to add for a specific market segment; it was a feature they had to build for their global strategy to be coherent.25

The result was the creation of one of the first website builders to offer identical functionality and features across phones, tablets, and desktop computers. This innovation, born directly from the constraints of serving mobile-first markets, turned out to be a breakthrough advantage for all users. A customer in San Francisco or London now benefits from the ability to seamlessly edit their website on their phone while commuting, a capability that competitors focused solely on the desktop experience could not offer. The constraint of the emerging market led directly to a superior product for the global market. This dynamic extends to other areas; the need to support users with diverse levels of digital literacy, for example, drives the development of clearer user interfaces and educational onboarding rather than exploitative upselling tactics.

Building a Sustainable Moat Through Superior Design

Products developed under the rigorous discipline of a global PPP model are not just different; they are often inherently better. They are designed from the ground up to be:

More Efficient: Built to perform well on lower-bandwidth connections and less powerful devices.

More Intuitive: Designed for users with varying levels of technical expertise, demanding clarity and simplicity.

More Focused: Stripped of non-essential features that do not provide clear value across a global user base.

These are not niche characteristics; they are the hallmarks of excellent, universally accessible product design. This creates a lasting competitive advantage. A product built this way has a "fitter" DNA. When a company honed in the hyper-competitive, low-margin environments of emerging markets enters a developed market, it often brings a product that is leaner, faster, and more focused than those of incumbents. This can be highly disruptive, allowing the new entrant to compete effectively on both quality and price.

Furthermore, this pricing strategy naturally steers a company toward a more efficient growth model. The low Average Revenue Per User (ARPU) inherent in many PPP-priced markets makes a high-touch, sales-led customer acquisition model economically unviable. It is impossible to sustain a sales team dedicated to closing deals worth a few dollars per month. Therefore, the product must sell itself. The onboarding process must be frictionless, the value proposition must be immediately obvious, and the user experience must be intuitive enough to minimize the need for costly support. This economic reality forces the company to adopt a Product-Led Growth (PLG) strategy, which is widely recognized as a more scalable and capital-efficient model for growth. In this way, the pricing strategy directly dictates a more sustainable and modern growth model.

V. The Evolving Landscape: Regulatory and Investment Imperatives

The strategic shift toward geographic pricing is not occurring in a vacuum. It is being accelerated by powerful external forces that are making the practice not just a competitive advantage, but a business necessity. Converging trends in regulation and investment are creating an environment where companies that engage in geographic price discrimination face increasing legal risk, while those that embrace intelligent, fair pricing are rewarded by the market.

Regulatory Tailwinds: The Global Crackdown on Geo-Discrimination

Governments and regulatory bodies are increasingly scrutinizing practices that create artificial barriers within the digital single market. The most significant and precedent-setting action in this domain is the European Union's Regulation (EU) 2018/302, commonly known as the Geo-blocking Regulation.

This landmark legislation directly targets "unjustified geo-blocking and other forms of discrimination based on customers' nationality, place of residence or place of establishment".28 The regulation's core principle is to allow consumers to "shop like a local." It explicitly prohibits traders from blocking or limiting a customer's access to an online interface based on their location, and it prevents them from automatically redirecting a customer to a local version of a site without their explicit consent.30 While the regulation does not mandate that a business must deliver goods everywhere, it does require that a customer from another EU country be able to access goods and services under the same conditions as a local customer.

The impact of this regulation is not merely theoretical; it is quantifiable. An empirical study conducted by the European Commission's Joint Research Centre (JRC) analyzed its effects on e-commerce activity. The findings were conclusive: the regulation was found to have increased real cross-border e-commerce activity within the EU by a range of 9.2% to 13%.32 This provides documented, quantitative validation that removing such barriers stimulates trade.

While the current regulation includes important exemptions, particularly for copyrighted content like streaming music and video, its existence establishes a powerful legal and philosophical precedent. The European Commission is actively engaged in evaluating the regulation's impact and considering its potential expansion, with ongoing calls for evidence from stakeholders to assess its effectiveness and identify remaining barriers.33 This regulatory momentum signals a clear trajectory: the legal tolerance for arbitrary geographic discrimination online is diminishing. The EU's actions serve as a model for other regions and put pressure on global companies to justify their cross-border sales practices. This trend acts as a significant tailwind for companies that proactively adopt fair and transparent pricing models like PPP.

The Investor's Viewpoint: Pricing as a Core Value Creation Strategy

The investment community, from early-stage venture capitalists to late-stage private equity firms, is increasingly focused on the sophistication of a company's monetization strategy. A well-conceived pricing model is no longer seen as a simple operational detail but as a critical indicator of a management team's strategic depth and a key driver of long-term value.

Leading venture capital firms like Andreessen Horowitz (a16z) have been vocal about this shift. Their analysis asserts that "Nothing is more critical to a software-as-a-service (SaaS) business than pricing strategy," especially for an early-stage company, where it represents the "moment of truth" for a new product.36 They argue that founders frequently "leave money on the table" by failing to align their pricing with the value their product delivers.

The insights from a16z and other market observers point to a broader evolution in SaaS monetization, moving away from simplistic per-seat licenses toward more dynamic, value-aligned models. These include usage-based pricing (paying for what you consume) and outcome-based pricing (paying for the tangible result delivered).37 Purchasing Power Parity is a macro-level application of this same value-based philosophy. It is a sophisticated form of customer segmentation that prices a product based on the economic value and outcome it can deliver within a specific national economy.

A company that can articulate a clear geographic pricing strategy demonstrates to investors that it has thought deeply about its total addressable market, its global value proposition, and the levers for sustainable growth. It signals an understanding that growth in the next decade will come from a diverse global user base, not just from extracting more revenue from a few wealthy markets. This level of strategic thinking is precisely what top-tier investors look for as they assess a company's potential for scalable, long-term success. The ability to implement PPP is thus a powerful signal of operational excellence and global market awareness, positioning a company as a more attractive investment.

This convergence of regulatory pressure and investor focus creates a powerful dynamic. The EU Geo-blocking Regulation and the rise of PPP pricing are two sides of the same coin: the erosion of artificial digital borders. The regulation attacks the problem from a legal, "right to access" perspective, while PPP attacks it from a commercial, "ability to purchase" perspective. Both trends are pushing businesses toward a future where a customer's geographic location does not arbitrarily prevent them from becoming a paying user. Companies that resist this dual-pronged movement will find themselves fighting against both regulators and fundamental market forces.

VI. Strategic Framework: Implementing Geographic

Pricing for Market Leadership

The evidence is clear: strategic geographic pricing is a proven driver of growth, a catalyst for product innovation, and an imperative in the face of evolving regulatory and investment landscapes. The final step is to translate this understanding into an actionable framework. This requires debunking unsubstantiated claims, defining the true market opportunity, and outlining a clear roadmap for implementation.

Debunking the Hype, Defining the Reality: Sizing the True Opportunity

To build a credible strategy, it is essential to ground it in verifiable data and to discard any misleading or inaccurate claims. The assertion in the original article of a "$2.3 trillion" market opportunity for PPP-priced software is a prime example of a figure that, while dramatic, cannot be substantiated and appears to be a misattribution from entirely different economic sectors.

Thorough research reveals the "$2.3 trillion" figure has been cited in multiple, unrelated contexts. Projections have used this number to estimate the future size of the global private credit market by 2027 39, the

MICE (Meetings, Incentives, Conferences, and Exhibitions) industry by 2032 40, the total capital in

global impact investments 41, and the projected private sector investment in

semiconductor wafer fabrication between 2024 and 2032.42 None of these relate to a market for PPP-priced software. Using such a figure undermines the credibility of the entire argument.

The true opportunity should be framed not with a single, sensational number, but with a more nuanced and defensible logic. The market is the vast, untapped potential of the digital economies in emerging nations. This can be sized through several credible lenses:

The User Base: The opportunity lies in reaching the billions of internet users in emerging markets. India alone has over 636 million internet users and is on track to become the world's largest music streaming market by volume.18 These are non-consumers who can be converted into paying customers with the right pricing.

Proxy Markets: The value of getting pricing right can be inferred from the growth of related software categories. The Conversion Rate Optimization (CRO) software market, which is dedicated to improving website effectiveness, is projected to reach between $3.56 billion and $5.07 billion by 2030.44 The broader

Price Optimization Software market is forecast to grow to $12.68 billion by 2034.46 These figures represent the value companies place on the tools needed to execute sophisticated pricing and conversion strategies.

The opportunity, therefore, is not a single, abstract trillion-dollar figure, but the tangible, multi-billion-dollar potential unlocked by converting millions of non-consumers into loyal, profitable customers through intelligent pricing.

A Roadmap for Implementation

Adopting a geographic pricing strategy requires a deliberate and phased approach tailored to the organization's scale and maturity.

For Corporate Strategists in Established Companies:

Audit and Identify: Begin by analyzing existing sales and website traffic data. Identify countries or regions that exhibit high traffic and engagement but have anomalously low conversion rates. These are your prime candidates for a pricing pilot.

Research and Model: Build a preliminary pricing index for a small set of 3-5 pilot countries. Use publicly available, authoritative data from sources like the World Bank (GDP), the OECD (Price Level Indices), and Numbeo (Cost of Living) to model an appropriate PPP-adjusted price for each pilot market.

Pilot and Measure: Launch a regional pricing test in the selected markets. This can be done through targeted promotions or by setting up region-specific landing pages. Meticulously track key metrics, including conversion rate, free-to-paid trial upgrades, and overall revenue impact compared to a control group.

Invest and Scale: If the pilot demonstrates a positive impact on conversion and revenue, secure investment to build or acquire the necessary technical infrastructure to scale the strategy globally. This includes multi-currency payment processing, automated price management based on a dynamic index like FairDif, and multi-language support.

For Entrepreneurs and Startups:

The key advantage for a new venture is agility. Build for a global audience from day one.

Embed PPP in the MVP: Do not treat geographic pricing as a future add-on. Integrate a basic PPP model into your initial product and business plan. This forces the product discipline and focus on core value discussed earlier in this report.

Leverage Global Feedback: Launching with accessible pricing in multiple countries provides a diverse, global user base for early feedback, bug testing, and identifying product-market fit across different cultures and use cases.

Grow Organically: Use fair pricing as a competitive advantage to drive organic, product-led growth, as demonstrated by the SimDif case study. This reduces reliance on early-stage marketing spend and builds a more sustainable business model.

For Investors (VC and PE):

Geographic pricing strategy should become a standard item on any due diligence checklist for a company with global ambitions.

Assess Strategic Acumen: Ask pointed questions: "What is your company's geographic pricing strategy?" "How do you account for purchasing power differences in your key growth markets?" A sophisticated answer indicates a management team with a deep understanding of global market dynamics.

Identify Risk: The absence of a geographic pricing strategy should be considered a significant risk factor. It suggests a limited Total Addressable Market (TAM), a potential vulnerability to more globally-minded competitors, and a lack of preparedness for the future of digital commerce.

Value the Moat: Recognize that a company with a well-implemented PPP system and a proprietary pricing index possesses a significant data-driven competitive moat that is difficult and costly for others to replicate.

Conclusion: The End of Flat-World Thinking

The architecture of the global economy demands a new architecture for digital pricing. The notion that a single price can effectively serve a world of immense economic diversity is a relic of a bygone era of market understanding. The evidence presented in this report leads to an unequivocal conclusion: strategic geographic pricing is not merely an ethical choice or a niche tactic, but a central pillar of modern business strategy.

The world's most successful digital platforms have already proven the model, using regionalized pricing to unlock unprecedented growth in emerging markets. The constraints of this approach have been shown to forge more innovative, efficient, and universally superior products. This internal, product-level advantage is now being amplified by external forces, as regulators move to dismantle artificial digital borders and investors reward the strategic sophistication that fair pricing represents.

The path forward is clear. For companies seeking sustainable growth and durable market leadership, the question is no longer if they will adopt strategic geographic pricing, but when. The choice is between leading this transition and shaping the future of their markets, or following in the footsteps of competitors who have already seized the vast opportunity hidden in plain sight. In a truly connected world, fair pricing is not just good business; it is the only business that makes sense.

Works cited

San Francisco city, California - U.S. Census Bureau QuickFacts, accessed June 26, 2025, https://www.census.gov/quickfacts/fact/table/sanfranciscocitycalifornia/PST045224

What is the income of a household in San Francisco County, CA? - USAFacts, accessed June 26, 2025, https://usafacts.org/answers/what-is-the-income-of-a-us-household/county/san-francisco-county-ca/

In all Bay Area counties, earning six-figures can still be considered 'low income' - KTVU, accessed June 26, 2025, https://www.ktvu.com/news/all-bay-area-counties-earning-six-figures-can-still-be-considered-low-income

San Francisco, Vienna or Mumbai? - Mint, accessed June 26, 2025, https://www.livemint.com/Sundayapp/fawrBXcpyLCkcgNPK3Cj6H/San-Francisco-Vienna-or-Mumbai.html

Mumbai real estate may seem cheap compared to the US, but income levels reveal a different story - Reddit, accessed June 26, 2025, https://www.reddit.com/r/mumbai/comments/zxsl8l/mumbai_real_estate_may_seem_cheap_compared_to_the/

Average Salary in India 2025: Average Income Per Person By Age, State, Gender - ClearTax, accessed June 26, 2025, https://cleartax.in/s/average-salary-in-india

75+ Mobile Surfing: Stats on Internet Traffic from Mobile Devices, accessed June 26, 2025, https://thriveagency.com/news/75-mobile-surfing-stats-on-internet-traffic-from-mobile-devices-updated/

Internet Traffic from Mobile Devices (June 2025) - Exploding Topics, accessed June 26, 2025, https://explodingtopics.com/blog/mobile-internet-traffic

Spotify premium subscription prices per country | Pulse Nigeria, accessed June 26, 2025, https://www.pulse.ng/articles/entertainment/music/spotify-premium-subscription-prices-per-country-2025040710591695107

Which countries pay the most (and least) for Netflix? - lovemoney.com, accessed June 26, 2025, https://www.lovemoney.com/gallerylist/395590/which-countries-pay-the-most-and-least-for-netflix

How Much Is Netflix a Month in 2025? Subscription Plans Prices ..., accessed June 26, 2025, https://www.g2a.com/news/features/how-much-is-netflix-a-month-in-2025-subscription-plans-prices-compared-across-countries/

Asia Pacific surpasses Latin America to become Netflix's third largest subscriber base - Ampere Analysis Insights, accessed June 26, 2025, https://www.ampereanalysis.com/insight/asia-pacific-surpasses-latin-america-to-become-netflixs-third-largest-subscriber-base

Report: Netflix to reach 8.2m new customers via Canal+ deal | Advanced Television, accessed June 26, 2025, https://www.advanced-television.com/2025/06/19/report-netflix-to-reach-8-2m-new-customers-via-canal-deal/

Netflix price drop affects more than 10m subscribers - Ampere Analysis Insights, accessed June 26, 2025, https://www.ampereanalysis.com/insight/netflix-price-drop-affects-more-than-10m-subscribers

How much does Spotify cost around the world? - Android Authority, accessed June 26, 2025, https://www.androidauthority.com/how-much-does-spotify-cost-around-the-world-3360533/

Indian Artists Are Reaching More Global Fans Than Ever Before (and the Data Proves It), accessed June 26, 2025, https://newsroom.spotify.com/2025-04-15/indian-artists-are-reaching-more-global-fans-than-ever-before-and-the-data-proves-it/

Spotify's Loud & Clear 2025 report reveals record growth for Indian artists - Business Today, accessed June 26, 2025, https://www.businesstoday.in/technology/news/story/spotifys-loud-clear-2025-report-reveals-record-growth-for-indian-artists-468589-2025-03-20

Global consumption of music from India soared 2000% in 5 years on Spotify, accessed June 26, 2025, https://www.musicbusinessworldwide.com/global-consumption-of-indian-music-soared-2000-in-5-years-on-spotify12/

India's Music Streaming Industry & Spotify Business Model - NextLeap, accessed June 26, 2025, https://assets.nextleap.app/submissions/Spotify-5d77a91a-f1ad-499e-b064-40723fae386c.pdf

Spotify Business Model - GrowthX Deep Dive, accessed June 26, 2025, https://growthx.club/blog/spotify-business-model

Netflix to increase prices as number of new subscribers rise - TV47 Digital, accessed June 26, 2025, https://www.tv47.digital/netflix-to-increase-prices-as-number-of-new-subscribers-rise-84875/

Spotify hikes prices by up to 22% across Benelux countries - Music Business Worldwide, accessed June 26, 2025, https://www.musicbusinessworldwide.com/spotify-hikes-prices-by-up-to-22-across-benelux-countries/

Which countries have the cheapest Netflix subscriptions? - Android Authority, accessed June 26, 2025, https://www.androidauthority.com/cheapest-netflix-countries-3360105/

Mapping How Much Netflix Costs In Every Country - Gulf Insider, accessed June 26, 2025, https://www.gulf-insider.com/mapping-how-much-netflix-costs-in-every-country/

The Story of The Simple Different Company, accessed June 26, 2025, https://about.simdif.com/

The Simple Different Company's Mission and Values, accessed June 26, 2025, https://www.simple-different.com/en/our-mission.html

Faiss indexes · facebookresearch/faiss Wiki - GitHub, accessed June 26, 2025, https://github.com/facebookresearch/faiss/wiki/Faiss-indexes

Geo-Blocking: a new Regulation enters into force - EUR-Lex, accessed June 26, 2025, https://eur-lex.europa.eu/content/news/geo-blocking-regulation-enters-into-force.html

Regulation 2018/302 - Addressing unjustified geo-blocking and other forms of discrimination based on customers' nationality, place of residence or place of establishment within the internal market - EU monitor, accessed June 26, 2025, https://www.eumonitor.eu/9353000/1/j9vvik7m1c3gyxp/vkmi6j5x3ez9

What the New Geo-blocking Laws Mean for Website Operators - Matheson, accessed June 26, 2025, https://www.matheson.com/insights/detail/what-the-new-geo-blocking-laws-mean-for-website-operators

Geo-blocking | Business Guide | CCPC, accessed June 26, 2025, https://www.ccpc.ie/business/wp-content/uploads/sites/3/2018/12/Geo-blocking-Guide.pdf

Geo-blocking regulation: An assessment of its impact on the EU Digital Single Market - EconStor, accessed June 26, 2025, https://www.econstor.eu/bitstream/10419/247407/1/jrc121480.pdf

Commission launches evaluation of Geo-blocking Regulation to assess its impact on the internal market | Shaping Europe's digital future, accessed June 26, 2025, https://digital-strategy.ec.europa.eu/en/news/commission-launches-evaluation-geo-blocking-regulation-assess-its-impact-internal-market

Commission launches evaluation of the Geo-blocking Regulation, accessed June 26, 2025, https://single-market-economy.ec.europa.eu/news/commission-launches-evaluation-geo-blocking-regulation-2025-02-11_en

Geo-Blocking Evaluation, CSDR Reform, Sustainability Directive De, accessed June 26, 2025, https://natlawreview.com/article/brussels-regulatory-brief-march-2025

The Price Is Right: And for Early-Stage SaaS Companies, It Needs to ..., accessed June 26, 2025, https://a16z.com/the-price-is-right-and-for-early-stage-saas-companies-it-needs-to-be/

Pricing & Packaging | Andreessen Horowitz, accessed June 26, 2025, https://a16z.com/pricing-packaging/

AI Is Driving A Shift Towards Outcome-Based Pricing (December 2024 Enterprise Newsletter) | Andreessen Horowitz, accessed June 26, 2025, https://a16z.com/newsletter/december-2024-enterprise-newsletter-ai-is-driving-a-shift-towards-outcome-based-pricing/

Is private credit a misunderstood giant in alternative investments? - InvestorDaily, accessed June 26, 2025, https://www.investordaily.com.au/markets/54819-is-private-credit-a-misunderstood-giant-in-alternative-investments

MICE Industry Expected to Hit $2.3 Trillion by 2032, to Grow at 11.6% CAGR From 2023-2032 - EIN Presswire, accessed June 26, 2025, https://www.einpresswire.com/article/823813629/mice-industry-expected-to-hit-2-3-trillion-by-2032-to-grow-at-11-6-cagr-from-2023-2032

"It is possible to have comparable financial returns and also measurable impact" - LSFI, accessed June 26, 2025, https://lsfi.lu/it-is-possible-to-have-comparable-financial-returns-and-also-measurable-impact/

EMERGING RESILIENCE IN THE SEMICONDUCTOR SUPPLY CHAIN, accessed June 26, 2025, https://www.semiconductors.org/wp-content/uploads/2024/05/Report_Emerging-Resilience-in-the-Semiconductor-Supply-Chain.pdf

The untapped opportunities of emerging markets | Startups Magazine, accessed June 26, 2025, https://startupsmagazine.co.uk/article-untapped-opportunities-emerging-markets

Conversion Rate Optimization Software (CRO) Market | Size, Share, Growth | 2023 - 2030, accessed June 26, 2025, https://virtuemarketresearch.com/report/conversion-rate-optimization-software-market

19 Conversion Rate Optimization Statistics for 2025 - WordStream, accessed June 26, 2025, https://www.wordstream.com/blog/conversion-rate-optimization-statistics

Price Optimization and Management Software Market Size 2034 - Market Research Future, accessed June 26, 2025, https://www.marketresearchfuture.com/reports/price-optimization-management-software-market-31617